These IRA contributions are not subject to federal income taxes or the 10 penalty for early withdrawals. 24Income Asset Limits for Eligibility.

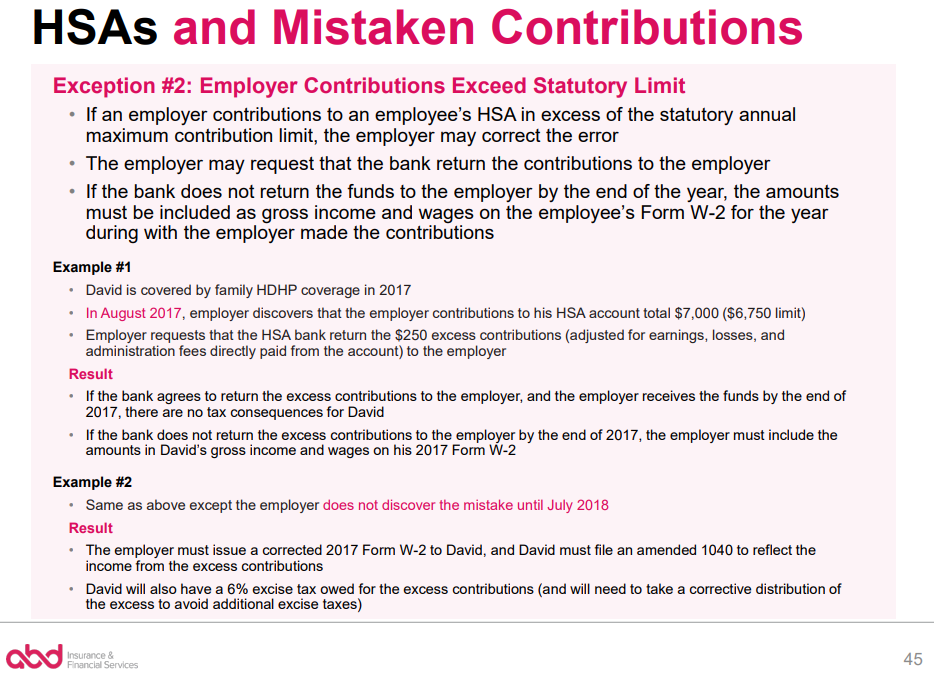

Excess Hsa Contributions Newfront Insurance And Financial Services

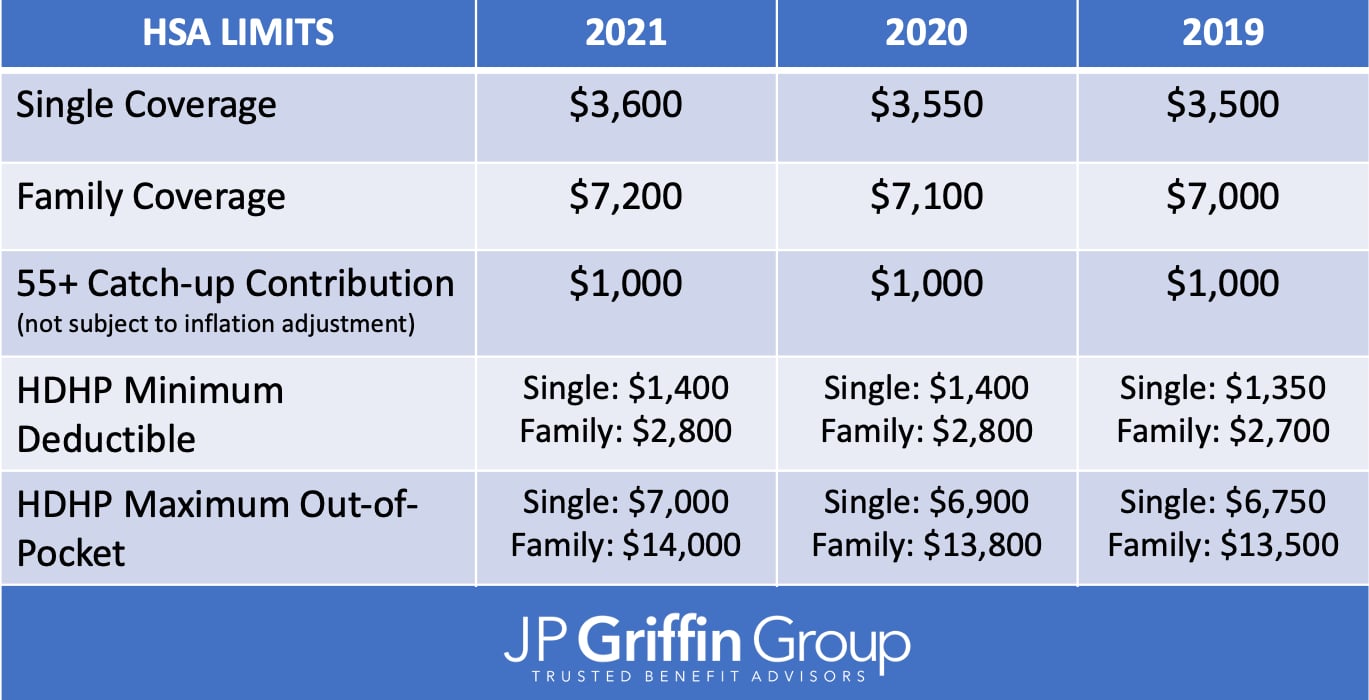

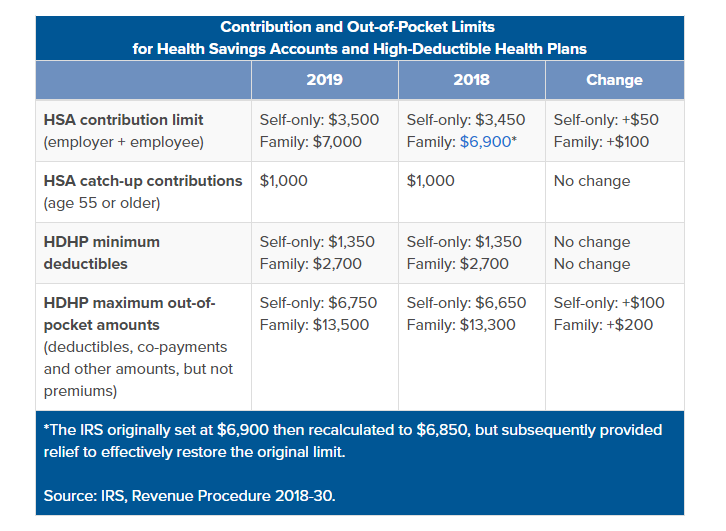

If you are age 55 or older at the end of your tax year your contribution limit is increased by 1000.

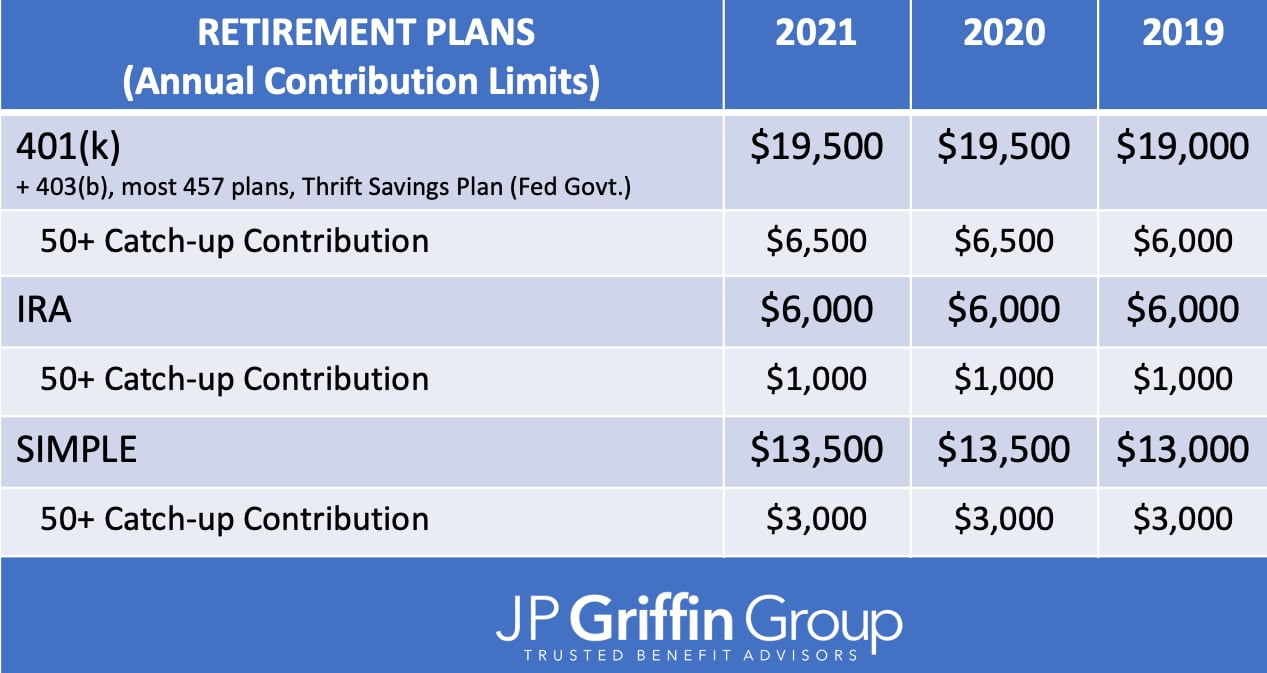

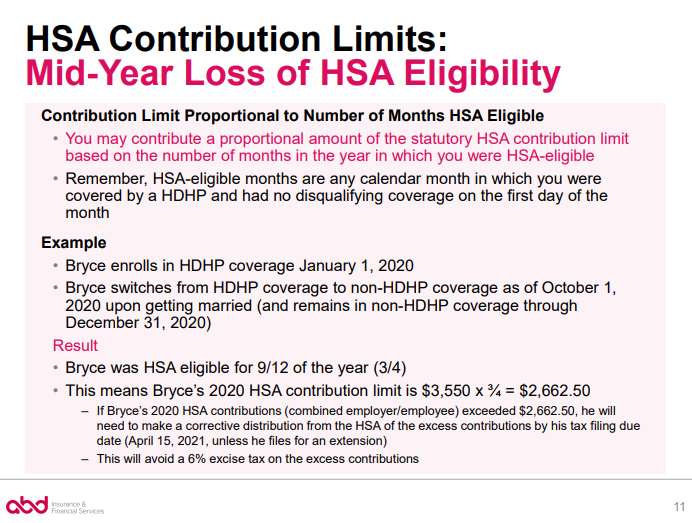

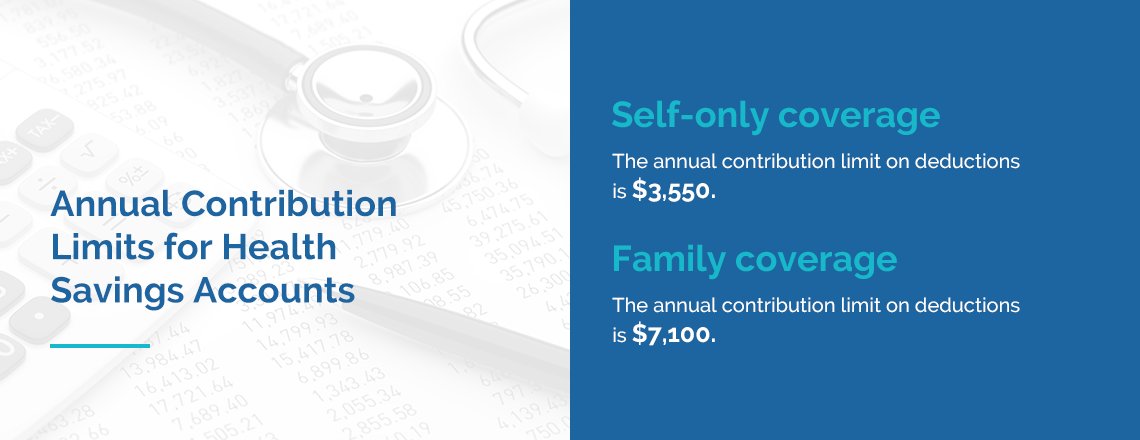

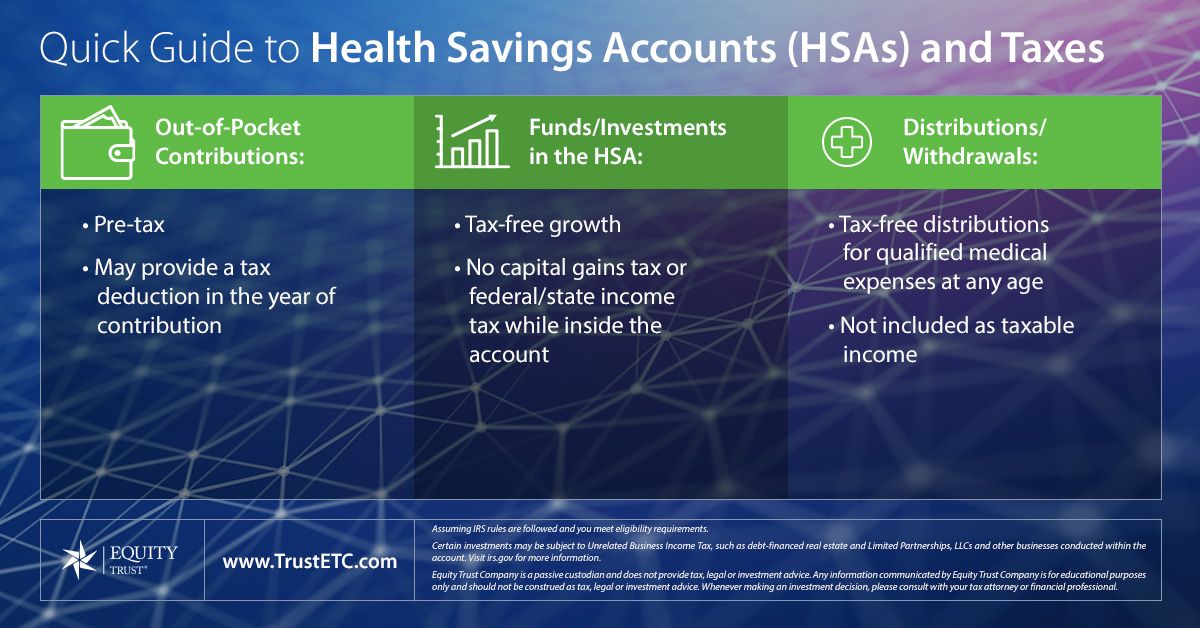

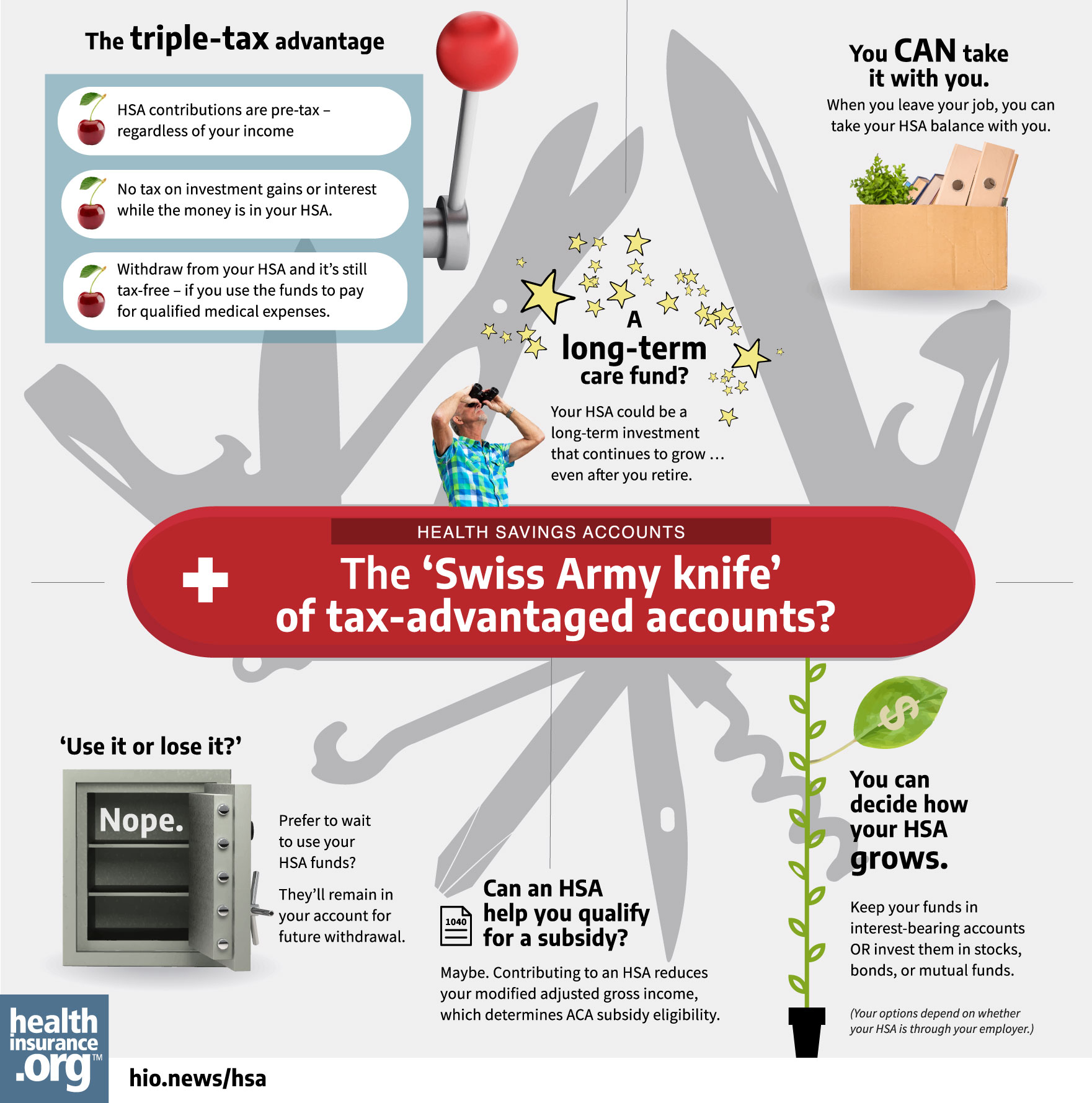

Are there income limits for hsa. 24However an HSA has big tax benefits. The regulations for HSA contributions For 2021 the self-only HSA contribution limit is 3600 and the family contribution limit is 7200. An HSA contribution from an IRA is a once-in-a-lifetime money transfer option.

Health Savings Accounts Take control of your healthcare dollars with a Health Savings Account HSA. First generally you wont pay federal income tax on money you deposit into your account. 2022 Limits for HDHPs and HSA Contributions Announced - 5112021 The IRS announced the following 2022 limits for high deductible health plans HDHPs and health savings accounts HSAs.

Were going to break down everything you need to know about HSA contributions for 2022 right here. This means you can use your IRA money to pay for medical expenses such as a major unexpected expense without having to pay federal income taxes or penalties on it. But no need to get into the weeds.

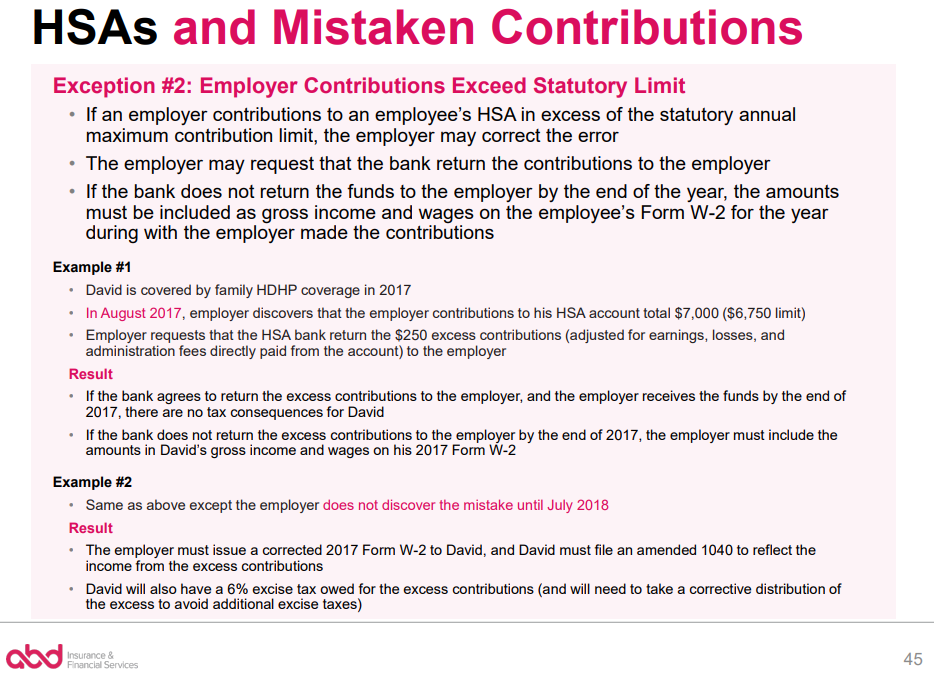

These limits for 2021 are. These programs have slightly different financial and medical eligibility requirements as well as benefits. Amounts are adjusted yearly for inflation.

4Will ACA income limits revert in 2023. But only an HSA lets you take tax-free distributions for qualified medical expenses. For an employees HSA the employee the employees employer or both may contribute to the employees HSA in the same year.

In 2020 the maximum contribution limits for HSAs were 3550 for individuals and 7100 for families. For an HSA established by a self-employed or unemployed individual the individual can contribute. Annual contribution limits are 6000 per year or 7000 if youre age 50 or older for 2020 and 2021.

22Rental income dividend or interest income or income from a deferred compensation plan doesnt count under IRS rules. There are several different Medicaid long-term care programs for which Kentucky seniors may be eligible. HSA Contribution Limits for 2022.

In 2022 individual HSA contribution limits will rise to 3650. Fortunately there are two different ways to handle HSA excess contributions which can help you avoid paying a penalty. 1There are penalties for exceeding your contribution limits so its important to make sure you and your spouse know the rules.

Use pre-tax dollars to pay for current and future medical expenses. Once you know if youre eligible for an HSA there are rules about how much you can contribute to your account each year. 7200 for family HDHP coverage.

Keep in mind the IRS sets limits on how much you can contribute each year. However there are five things you can start doing today to prepare. Here are the HSA contribution limits for 2020 and for 2021.

401K Both accounts let you make pre-tax contributions and grow tax-free earnings. What is an HSA Excess Contribution. 3600 for self-only HDHP coverage.

After age 65 you can use your health savings account for any expense youll simply pay ordinary income taxesjust like a 401k. 25If you have more than one HSA in 2020 your total contributions to all the HSAs cant be more than the limits discussed earlier. You must reduce the amount that can be contributed including any additional contribution to your HSA by the amount of any contribution made to your Archer MSA including employer contributions for the year.

Yes if Congress doesnt take further action. In fact in most cases there are three ways an HSA helps you keep your money in your pockets and out of Uncle Sams. The family HSA contribution limit will rise to 7300.

If you have an HSA we recommend funding it as much as possible even maxing. An HSA combines a high-deductible insurance plan with a tax-exempt savings account. Reduction of contribution limit.

14However there are rules for how much you can save in your HSA each year. Any eligible individual can contribute to an HSA. If HSA funds are used for an ineligible expense whether medical or non-medical then you may have to pay income tax on the amount and for individuals who are not disabled or.

14There are yearly limits for deposits into an HSA.

2021 Irs Hsa Fsa And 401 K Limits A Complete Guide

2021 Hsa Contribution Income Limits Individual And Family

Hsa Contribution Limits What To Watch Out For When Families Have Multiple Accounts

Health Savings Accounts How Hsas Work And The Tax Advantages

2019 Fsa And Hsa Contribution Limits Stratus Hr

The Hsa Proportional Contribution Limit Newfront Insurance And Financial Services

2021 Hsa Contribution Income Limits Individual And Family

2021 Irs Hsa Fsa And 401 K Limits A Complete Guide

2021 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsas High Deductible Plans Health For California Insurance Center

Hsas Fsas Eligibility And Contribution Limits Hays Companies

Hsa Planning When Both Spouses Have High Deductible Health Plans

Health Savings Accounts Eligibility Distributions And More Lord Abbett

Hsas Fsas Eligibility And Contribution Limits Hays Companies

Irs Announces 2021 Limits For Hsas And High Deductible Health Plans

2019 Fsa And Hsa Contribution Limits Stratus Hr

Historical Health Savings Account Limits 2004 To 2021 Dqydj

Post a Comment

Post a Comment